Sincerely, BLLA

Boutique Hotels are Appealing to Both Guests and Investors Right Now

An overview of the U.S. hospitality market The boutique sector is looking more promising than ever. Examining the facts and figures during her sess...

Sincerely, BLLA

An overview of the U.S. hospitality market The boutique sector is looking more promising than ever. Examining the facts and figures during her sess...

The boutique sector is looking more promising than ever. Examining the facts and figures during her session at the Boutique Lifestyle Digital Summit by BLLA, Vail Ross, SVP of Global Business Development & Marketing at STR, showed just how much of an economic uptick BLLA’s boutique audience can expect as the year comes to a close and where she expects the hospitality industry to be at the end of 2021.

The U.S. market started out the year with a RevPAR of 2.1% in January and 1.6 in February, which showed growth overall. When the pandemic hit in March, monthly trends U.S. hit a dismal low: -51.6% in March, the lowest level of -80% in April, and other low levels leading up to -47.5% in August.

Since August, both the U.S. and Europe are experiencing normal seasonal slow-downs as the summer draws to a close. However, from a shared occupancy level in China, things are back to normal. Ross pointed out that in looking at weekly RevPAR numbers, there is a clear correlation between decline and new COVID-19 cases and the ability to lessen the blow in the industry’s RevPAR declines. This is evident through Labor Day in the U.S., when cases were slowing down and RevPAR was at -32.8%, an improvement compared to the preceding months.

The luxury hotel segment has been the most impacted, but Labor Day Weekend occupancy rates should give hope to the entire hospitality industry. The select service segment yielded occupancy rates over 50%, and the luxury and upscale segments are moving in the right direction, Ross remarked. Some particular markets that had exceptionally promising weekend occupancy rates over Labor Day included Colorado Springs (91.5%) and Daytona Beach (90.6%). These key markets stood out due to their drive location and geographical features such as beaches or mountains where guests felt safe.

Focusing in on boutique hotels, Ross reported that the steepest RevPAR declines for boutique hotels occurred in July at -27.6%. She is hopeful that this is the steepest decline we’ll see for the boutique segment. The lowest occupancy rate of 12.4% for open boutique hotels occurred in April.

Location has proven to be a key factor in boutique hotel performance. Ross revealed that In July, the RevPAR percentage change for urban properties was -58.4%; suburban locations were -54.1%; resort settings were -27.8%; and small town/metro locations were -41.8%. The low numbers come as a result of the location’s dependency on corporate travel, which is currently lagging in the travel market.

Similarly, boutique hotels in urban settings were operating at 40.5% occupancy; suburban locations at 38.4%; resort properties at 48.6%; and small town/metro hotels at 39.1% in July. In comparison, these hotels were operating at 80% occupancy in July of 2019. The resort segment’s higher occupancy number is indicative of people becoming more comfortable travelling to properties that provide outdoor space to move around.

Ross also explained that boutique hotels trends are very similar to those of other luxury and upscale hotels, even slightly better. The driving factor in this situation is the transient consumer, including guests who stay at a hotel on their own volition, those under contract work, or frontline workers. In a comparison of transient actual occupancy versus group actual occupancy, transient travel resulted in 33% occupancy, while groups held 7% occupancy. Likewise, transient RevPAR was 50.1%, while group RevPAR was -53.1%. Transient room demand was four million rooms, while group room demand was 869,000 rooms. The boutique segment is evidently moving in an upward direction.

In STR’s 2020 year-end outlook, the independent chain scale will have a -37.9% change in occupancy, a -17.8% ADR change, and a -48.6% RevPAR change. However, the company’s 2021 year-end outlook looks much more positive for independent hotels, with occupancy up 33.2%, ADR increased 3%, and revpar increased 37.3%.

As for the ever-important timeline of when 2019 economic levels will return, according to Ross, it won’t happen until 2023 in some cases, but in some cases, not until 2024. This is largely dependent on vaccine development and distribution, and other economic factors.

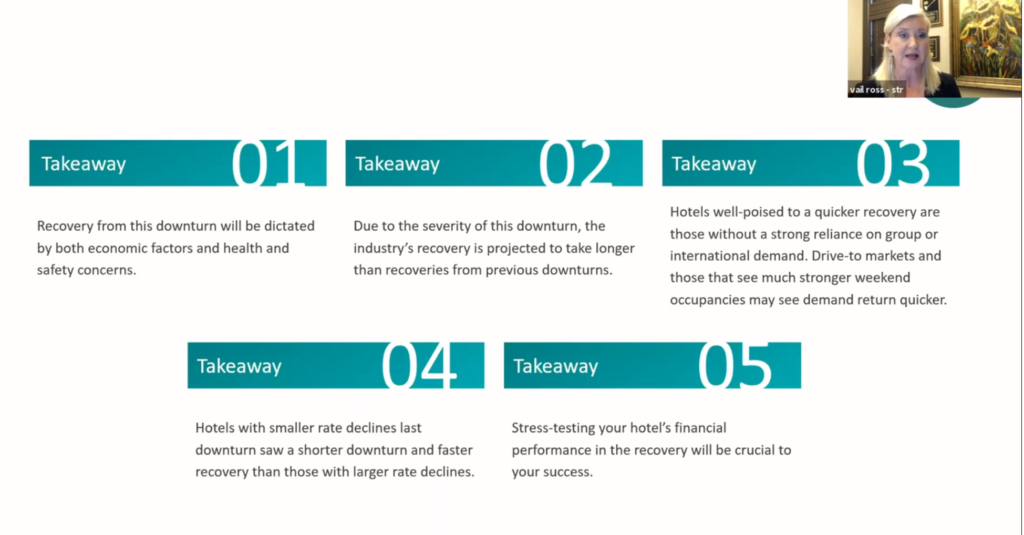

Ross left the Digital Summit audience with some key takeaways from her session to advise viewers and provide speculations of where the industry will head. One of her most important points was that “Hotels with smaller rate declines last downturn saw a shorter downturn and faster recovery than those with larger rate declines.” She also emphasized, “Stress-testing your hotel’s financial performance in the recovery will be crucial to your success.”

And finally, in positive news for the boutique segment, Ross declared, “Hotels well-poised to a quicker recovery are those without a strong reliance on group or international demand. Drive-to markets and those that see much stronger weekend occupancies may see demand return quicker.” Ross’ presentation is evidence that boutique hotels are in an optimal position in the marketplace and will be appealing to investors and guests alike in the coming year.

Shaping Unique Experiences and Future Trends in Hospitality In an evolving travel landscape, boutique hotels have emerged as significant players, r...

We are thrilled to unveil the theme for the 2024 Boutique Hotel Owners Conference by BLLA: "The Mycelium Network." This year, we dived into the profo...